Hey, all fellow money-making enthusiasts! I continue to explore the innovative AI trading platform AlgosOne and share the entire process so that you can, based on my experience, decide whether entrusting your funds to this impersonal yet highly potential creation is worthwhile. So, get yourself ready, here’s the latest update on my account.

This week hasn’t been as profitable as some in the past. But you know, I’ve had weeks of trading on Binance where I closed only losing positions. That didn’t stop me from earning much more later. So, unsuccessful trades don’t scare me now, as I’m always geared towards long-term success. In that regard, having a positive balance between successful and unsuccessful trades in AlgosOne suits me just fine at this stage. Knowing there’s no commission for unsuccessful trades makes me feel more relaxed.

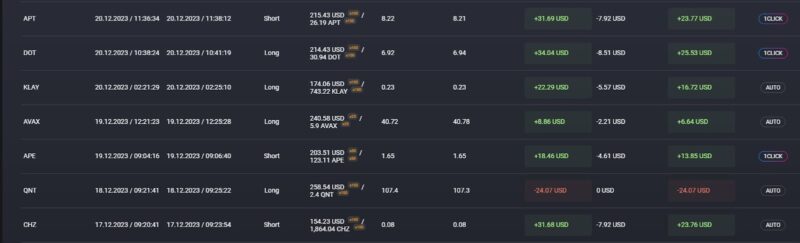

Now, let me spill the beans on a few trades that the AI pulled off for me this week—the ones that I find particularly interesting. The big winner was a long position in the USD/COP pair. Dealing with a coin that doesn’t exactly top the market cap charts, it still raked in +28.8 USD after the commission cut. Another one catching my eye is a short position, this time in the USD/PLD pair, recommended by the platform. Sure, I ended up in the red, but what excites me is that the AI is sniffing out completely different trading opportunities, including tokens tied to the gaming scene.

Gone are the days of exclusively working with the top 10 tokens; now, it’s all about navigating this ever-growing market and digging up coins with real potential. I reckon this is one of the main perks of having AI on our side as traders. No need to get bummed out. Let’s capitalize on this!

Over the course of using the AlgosOne platform, my checking account has racked up 92 USD. Now, I’m faced with a dilemma, trying to figure out what to do with these funds. Sure, I could keep them chillin’ in my checking account and let that sum grow over time. But, on the flip side, there’s the option to reinvest this profit, potentially beefing up my game on the platform down the road. Another thought is to cash out the profit, plus it’s a chance to test-drive that whole withdrawal process. Let me know in the comments which move you think would be the smart play.

Also, just a heads-up, I’ve got a referral link for those who’ve caught the vibe from my journey and are ready to dive into their own adventure with AlgosOne: https://algosone.page.link/iF7R