I know you’ve been waiting for it. Here’s a quick update on my AlgosOne account situation and my experience with the first withdrawal trial. Just to remind you, I’ve recently started using a new AI trading platform and documenting my entire journey here.

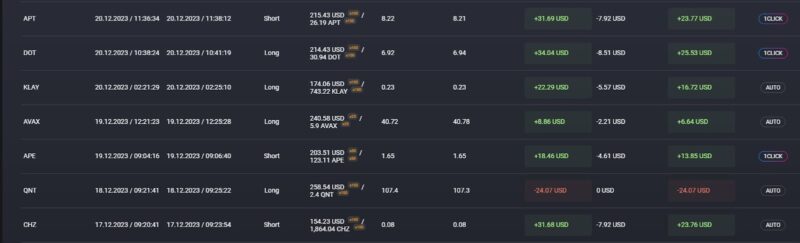

Let’s begin with an overview of the trading results. Since my last update, the crypto market has been quite volatile, with BTC prices jumping between 39K and 47K USD in a short period following the ETF approval. My AI friend and I did not manage to make significant profits or incur substantial losses during this period. The balance is growing slowly, and I’ve reached 187 USD in my checking account. If we include the 100 USD I reinvested from profits into the trading balance, we’ll have a total of 287 USD in profits from 99 successful and 71 unsuccessful trades in my account.

As I mentioned earlier in my posts, when it comes to trading platforms, all the benefits do not make any sense if there are any withdrawal problems. That’s why, before recommending AlgosOne to others or investing a substantial amount, I decided to check the withdrawal process myself. This has been my original strategy since the beginning, and now I have generated enough to try the withdrawal system.

To move my first profits out of the platform, I clicked on “Balance” and chose a checking account. From the options of reinvesting, buying shares, and withdrawing, I selected the last one and filled out the request form. It is important to mention that, even though you can deposit using different cryptocurrencies or even a bank transfer, withdrawals are only available in USDT on the ERC-20 network. It’s not a problem for me, to be honest, but I hope AlgosOne will improve it for a better user experience.

I decided to put in a request for $150 (minus a $10 fee), and after around 40 minutes, I received 140 USDT in my wallet. I would say I’m satisfied with the way this system works and look forward to continuing my AI trading journey.